Discovery.

The Nest's mission is to create a more robust ecosystem for entrepreneurship in frontier markets and provide investors from around the world direct connections and insights into markets they otherwise may not be in. A number of frontier markets are experiencing tremendous growth and have capable entrepreneurs addressing basic problems and critical needs in their countries.

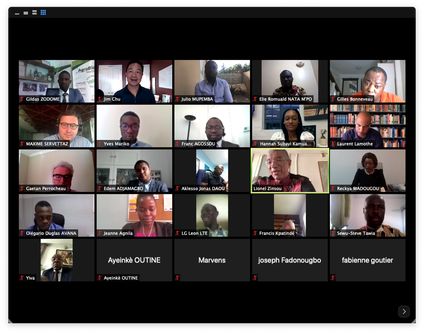

The Nest involves angel investors from around the world to participate in sessions of the Nest. The Nest team sorts through hundreds of applications and opportunities to select a few investable, often overlooked, opportunities in these markets. We then attempt to match these companies with angel investors open to meeting and hearing pitches from them.

There are no fees or obligations for either entrepreneurs or investors, and the forum is meant to be an open forum where anyone with a good idea or the willingness to invest in startups can participate. It's all virtual, so there are no travel visas needed or fees for VIP passes, etc. and usually only takes up the time of a zoom video call.

Each company presents for 5 minutes and 20 minutes is then left open for questions and discussion between the angels and the entrepreneur as well as comments and questions from the audience. Each session has 2 companies presenting and usually lasts between 1 hour and 90 minutes. All sessions are recorded and past sessions can be viewed here.

The Nest involves angel investors from around the world to participate in sessions of the Nest. The Nest team sorts through hundreds of applications and opportunities to select a few investable, often overlooked, opportunities in these markets. We then attempt to match these companies with angel investors open to meeting and hearing pitches from them.

There are no fees or obligations for either entrepreneurs or investors, and the forum is meant to be an open forum where anyone with a good idea or the willingness to invest in startups can participate. It's all virtual, so there are no travel visas needed or fees for VIP passes, etc. and usually only takes up the time of a zoom video call.

Each company presents for 5 minutes and 20 minutes is then left open for questions and discussion between the angels and the entrepreneur as well as comments and questions from the audience. Each session has 2 companies presenting and usually lasts between 1 hour and 90 minutes. All sessions are recorded and past sessions can be viewed here.

Tips for Angel Investors

The Nest team will send out decks of the companies to the angels for each week a couple days before each session. There is a no obligation to invest, of course, but we if there is interest after the session, we will introduce all those who expressed interest in the company to the entrepreneur so that they can continue the conversation. The Nest's involvement ends there. While the Nest team does its best to find strong companies that are investable, it is up to each angel to perform their due diligence. It is very common for angels to form informal and formal syndicates for due diligence and for investment, pulling in those during the session that expressed interest as well as their extended network.

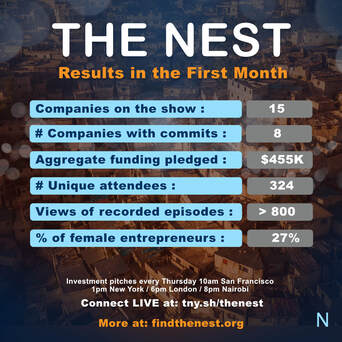

Most companies are seed or Series A companies with an occasional Series B and pre-seed company. To date, investments have ranged from $5,000 commitments to $100,000. Over $500,000 of investment into seed and series A companies have been made from connections through the Nest since the Nest's first session on April 23rd, 2020.

The Nest team will send out decks of the companies to the angels for each week a couple days before each session. There is a no obligation to invest, of course, but we if there is interest after the session, we will introduce all those who expressed interest in the company to the entrepreneur so that they can continue the conversation. The Nest's involvement ends there. While the Nest team does its best to find strong companies that are investable, it is up to each angel to perform their due diligence. It is very common for angels to form informal and formal syndicates for due diligence and for investment, pulling in those during the session that expressed interest as well as their extended network.

Most companies are seed or Series A companies with an occasional Series B and pre-seed company. To date, investments have ranged from $5,000 commitments to $100,000. Over $500,000 of investment into seed and series A companies have been made from connections through the Nest since the Nest's first session on April 23rd, 2020.